non resident tax malaysia

Income Tax For Foreigners Working in Malaysia 2022 Non-resident working in Malaysia. Non-Resident You are considered a non-resident for tax purposes if you stay in the country for a period of less than 182 days in a year.

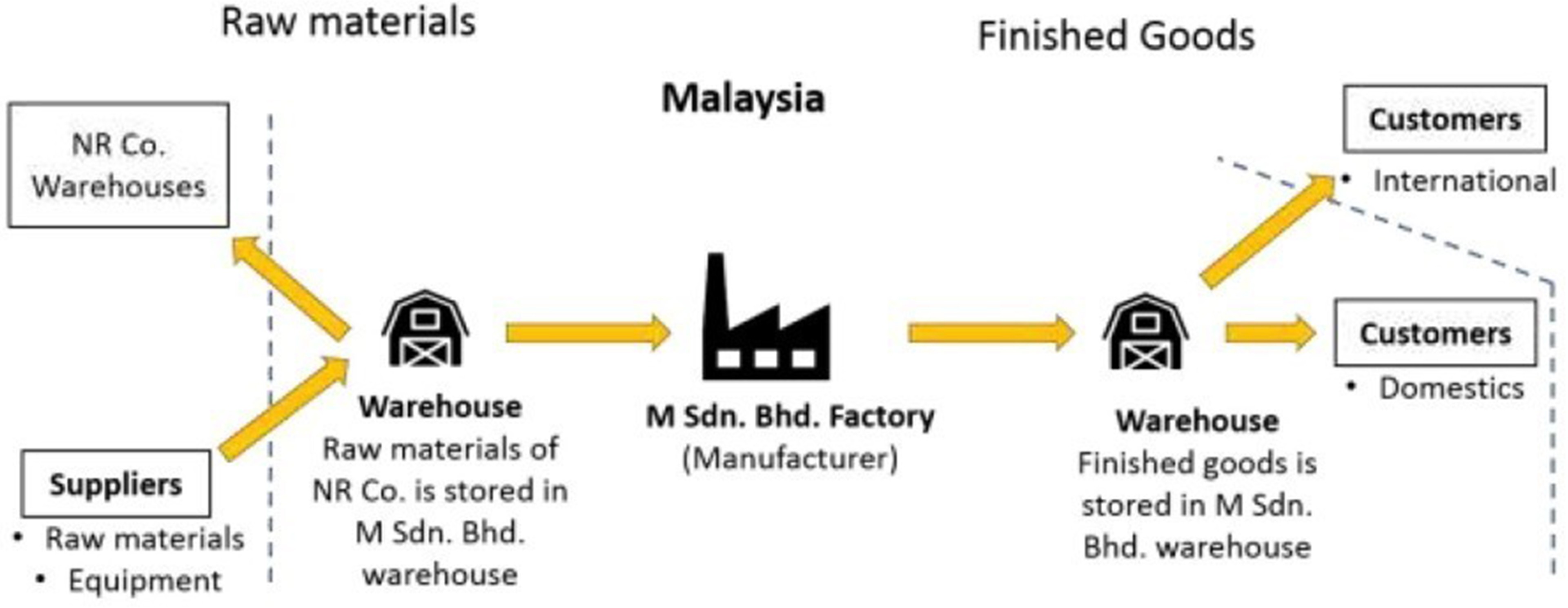

Tax Treatments Between A Resident Non Resident Company

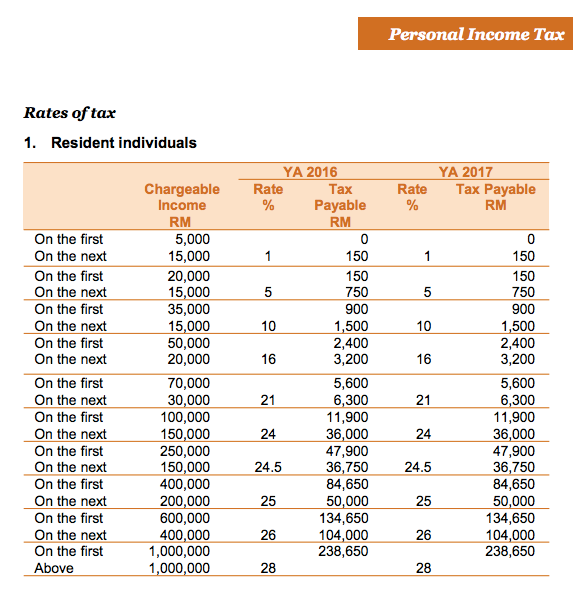

In Malaysia the principal difference between a resident and non-resident is that the non-residence is taxed at a rate of 30 without being eligible to enjoy any tax.

. 10 rows Non-resident companies are liable to Malaysian tax when it carries on a business through a. With the introduction of the single tier dividend system effective 112008 all dividends are tax free. The non-resident tax rate in Malaysia is a flat rate of 30 on all taxable income².

Non-Resident means other than a resident in. If the non-resident landlord does not have a letting agent his tenant must deduct the tax but only if the. Whereas for non-residents income earned would be subjected to a flat tax rate of 28.

13 rows 30. Malaysian tax residents - what income is taxable. Assuming youre a local tax resident youll.

Effective from 2018 Year Assessment the corporate taxation rate applies to Malaysian Sdn Bhd companies of a resident status as follows. You are non-resident under Malaysian tax law if you stay less than 182 days in Malaysia in a year regardless of your citizenship or nationality. The Scheme applies to let agents regardless of the amount of the rent involved.

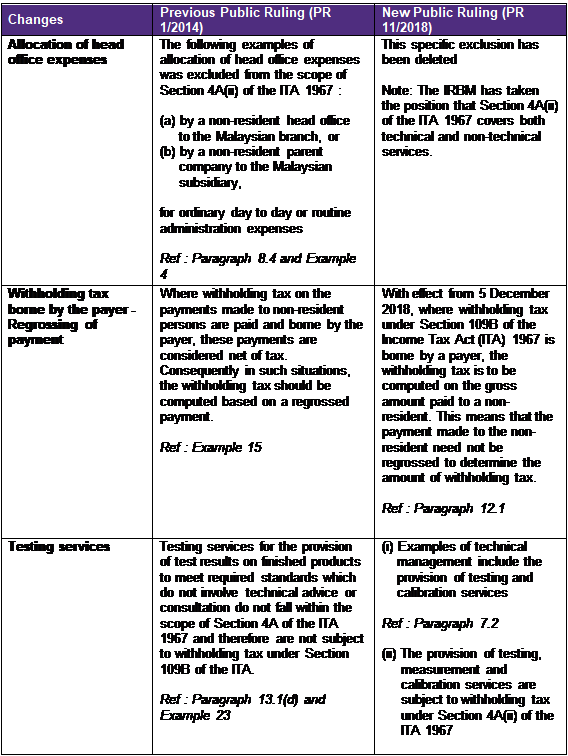

A non-resident individual is taxed at a flat rate of. You are considered as a non-resident under the Malaysian tax law if you stay less. Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors.

Non-resident individual is taxed at a different tax. Malaysia has implementing territorial tax system. The rate of NRT is 15 on the gross amount of such income 15 in relation to management fees and 10 in relation to income derived from a mining project by way of interest royalty.

Both residents and non-residents are taxed on income accruing in or derived from Malaysia. All expats must notify the Non-Resident. An income earner earning RM100000 if heshe is a non tax resident the tax rate would be 30 which is RM30000.

Resident means resident in Malaysia for the basis year for a year of assessment YA by virtue of section 8 and subsection 61 3 of the ITA. An individual whose employment period in Malaysia exceeds 60. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30.

As for a tax resident the effective tax rate is approximately. Foreign income remitted into Malaysia is. The status of individuals as residents or non-residents determines whether or not they can claim personal allowances generally referred to as personal reliefs and tax rebates.

Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year. Income earned by residents are subjected to a scaled income tax rates from 0 to 28. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500.

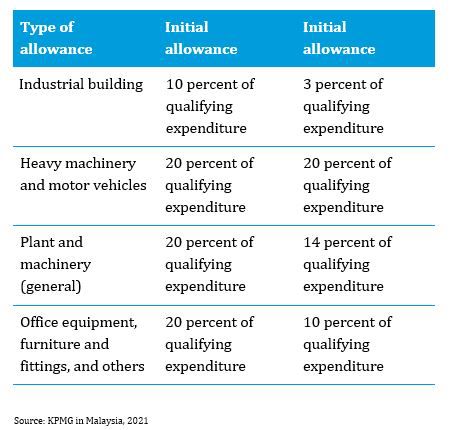

Net Profit below RM 500000 19 Every. This enables you to drop down a tax bracket lower your. Foreigners who qualify as tax-residents follow the same tax.

A non-resident individual who exercises employment in Malaysia for not more than 60 days is exempt from Malaysian tax.

Mwka Online Talk Am I A Tax Resident In Malaysia

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Taxplanning What Is Taxable In Malaysia The Edge Markets

Guide On Personal Tax Filing For Expatriate Employed By Labuan Company

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Tax Guide For Expats In Malaysia Expatgo

Malaysian Tax Issues For Expatriates And Non Residents Toughnickel

Malaysian Tax Issues For Expatriates And Non Residents Toughnickel

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

Tax Alert Grant Thornton Malaysia

Tax Reporting For Non Profit Organizations Npos In Malaysia Semantic Scholar

Am I A Tax Resident In Malaysia Youtube

8 Countries With Zero Foreign Income Tax

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Taxation Of Cross Border M A Kpmg Global

Guidelines On Determining If A Place Of Business Exists In Malaysia Ey Malaysia

Tax Treatments Between A Resident Non Resident Company

0 Response to "non resident tax malaysia"

Post a Comment